Price Action Simplified – Decoding The Dance of The Stock Market

The stock market is a game of ups and downs of stock prices. But hey, what price action tells you is the whole story of what happened in the history so you can decode what may happen next. Easy peasy, right!

The concept of price action study is very crucial yet super convenient to understand.

It’s time to not waste time on building up the plot but get into this one of the most fascinating concepts of technical analysis in the stock market.

Let’s get rolling.

What is Price Action?

In simpler terms, price action is the movement of a stock’s price on a chart over time. It is a significant element of technical analysis along with volume and volatility that records the price movements of a stock or indices so traders can make sense of market’s dance moves.

What it requires – observing how prices swings and spotting patterns that can help traders make informed decisions.

For instance, consider price action like the clouds – once you start observing it closely, you can find its repetitive behaviour, patterns, and types.

How it helps – after observing clouds for seasons – you can make predictions about its future movements, make sense of different patterns and make informed decisions.

What is Price Action in Trading?

As mentioned earlier, the price action in trading focuses on the movements of price plotted over a certain tenure. It is one of the rudimentary aspects of technical analysis and study of any securities such as bonds, stocks, derivatives, and commodities.

Well, in layman terms, everything that is bought and sold in the market creates price action. Price action often noted in the market of high volatility and liquidity. But eventually, everything that is traded in the market, drafts a price action.

Among all the technical indicators and analysis techniques that come from price-action and volatility, price action can be differentiated on the ground of “first-hand” approach. Why? Because it fetches data directly from the market, despite depending on price action, volatility, or other stock market factors.

Why do traders use it?

To make speculations and predictions about the market and enter/exit at the best time. If price action is removed from the charts, it is called ‘naked trading’, ‘clean chart trading’, or ‘’raw natural trading’.

Well, many traders, after observing these price actions (clouds), found patterns that were repetitive and predicted specific movements. Some of these patterns are the bullish candlestick pattern, hammer, Piercing line, Inverse hammer, Shooting Star, Evening Star, The Hanging Man, etc. In fact, technical analysis indicators or tools such as moving averages can only be estimated with price action.

But critics believe that what happened in history will not necessarily be repeated in the future. Hence it’s crucial for traders to not blindly believe but focus on research and observation of the market, instead being completely reliant on price action study.

What Does Price Action Tell You?

Price actions in trading is like reading a story told by the stock market. Every price movement in stocks, whether it’s down, up, or sideways, is a byte of information that traders use to make trading decisions and decrypt market sentiment. Traders use price action of securities for different purposes, including estimating moving averages, identifying reversals, breakouts, and decoding trends.

For example, price action is like watching a football game. You observe a player’s movements and positions on the field and make guesses on the next score. Akin to this, traders/investors use price action to forecast the market waves and its flow.

In broader view, price action helps traders visualize the fluctuations in the price open, close, high, low, and difference occurred over time. Technical analysts also use price action data to measure technical indicators, conventional patterns, or potential breakout.

How to Use Price Action

Now to understand this, let’s imagine you have a favorite tree in your backyard. Every day, you observe the tree and notice how its branches move with the flow of wind. Sometimes, the branches sway gently, and other times, they move more aggressively.

Similar to watching the branches of this tree, price action is when the price of any security moves up, down, or stays in the same lane. Traders/investors watch these movements carefully, just like watching the branches of your favorite tree.

Unlike trading tools and indicators, price action is the source of data from which all these tools, theories, and patterns are built. Often trend traders and swing traders take a close look at the price, to anticipate support and resistance levels and predict consolidation and breakouts, without using the fundamental analysis

Nowadays, in the new digital era, the usage of algorithms have become popular among traders/investors for more accurate and precise prediction. According to Securities and Exchange Commission (SEC) 2020, the use of algorithms is rising for analyzing and executing trades.

Benefits & Limitations

Well, with perks comes the limitations. A pro trader familiarizes oneself with both sides of the story to soak into it enough to make the best out of it. Here, let us give you the brief:

| Benefits of Price Action | Limitations of Price Action |

| Helps simplify trading decisions by focusing on price movements | Requires a good understanding of price action patterns and market dynamics |

| Can be used in any market condition (trending, ranging, volatile) | Relies heavily on subjective interpretation, which can lead to different conclusions |

| Provides clear entry and exit signals based on price action patterns | Does not account for fundamental factors that can influence price movements |

| Helps traders develop a deeper understanding of market psychology | May not be suitable for beginners without sufficient training and practice |

| Can be used on any timeframe, from short-term to long-term | Does not guarantee success and can result in losses if not used correctly |

Price Action Trading Strategies (Patterns)

Like judging the clouds on the basis of different patterns, expert traders/investors have listed a few price action patterns that give a strong clue on ‘what next’ to a trader.

Also known as ‘signals’, ‘trigger’ or ‘setups’, these designs hold the transcription of candle movements.

Let’s know more about it:

Inside Bar Pattern

Inside bar pattern is a two-bar pattern that includes one “Mother Bar” and one “Inside Bar”. Inside bar always comes after the mother bar and stays within its range. This is most commonly considered as a sign of reversal or breakout pattern whenever a trader spots one.

Pin Bar Pattern

A pin bar is often known as a single candlestick that shows one range of price direction and then a reversal in the market. It can be either bearish pin bar or bullish pin bar patterns, which can also be traded counter-trend from a key-support or resistance level. The pin bar says that the price might go in the opposite direction from where its tail is pointing.

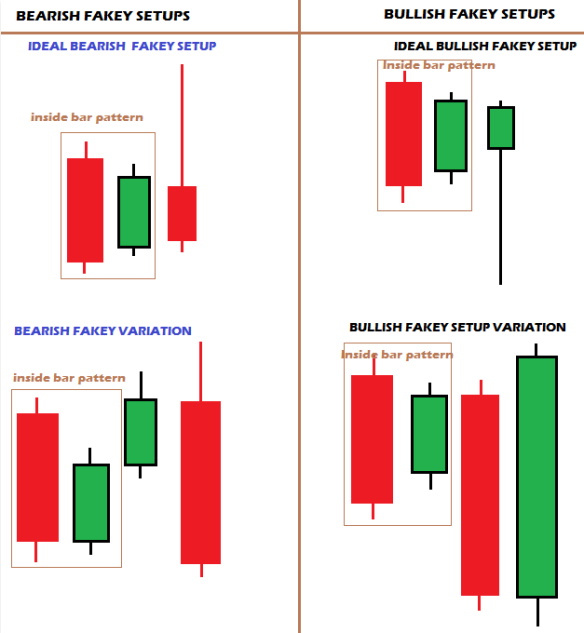

Fakey Pattern

Fakeout version of the inside bar pattern is known as fakey pattern in the books of price action patterns. In this, the price ranges within the mother bar and creates an illusion of breakout in the third candle. But technically it is fakey, pretending to move in one direction just to fake the whole range.

Although these patterns have been home for many traders to understand the price action, these are not foolproof strategies to enter/exit the market. Experts recommend to complement (not cloud) these patterns with significant indicators or theories such as demand-and-supply, EMA, etc. for more informed decision making.

Also Read: Understanding the Benefits of Holding Stocks for the Long Term

Difference Between Price Action, Technical Analysis & Indicators

Let’s review the difference among technical analysis, indicators, and price action. This will help establish the distinction and help get acquainted with the dots that connect them yet keep them apart.

| Aspect | Price Action | Technical Analysis | Indicators |

| Definition | Reading price movements directly | Analyzing past market data to | Mathematical calculations based |

| from the price chart without | predict future prices | on price, volume, or other data | |

| using indicators | to predict future prices | ||

| Approach | Using patterns and trends | Using tools like charts and | Using formulas to calculate data |

| on the price chart to make | indicators to analyze trends | points for trading signals | |

| trading decisions | |||

| Ease of Use | Can be simple but may need | Requires learning different | May require understanding of |

| practice | analysis methods | financial markets | |

| Flexibility | Can be used in any market | Can be used in different markets, | Can be customized and combined |

| or timeframe | timeframes, and assets | for different strategies | |

| Reliance on | Does not rely on indicators | May rely on indicators for | Depends solely on indicators for |

| Indicators | or complex calculations | analysis | signals |

| Emphasis | Focuses on price movements and | Focuses on historical data and | Focuses on specific data points |

| patterns directly from the chart | indicators for future predictions | or calculations for predictions |

In A Nutshell

Price action is the base of stock market study over the years as it lays the foundation of several theories, conventional patterns, and relative comparison from history. However, with the advancement, traders/investors are focusing more on algorithm based trading i.e. more precise and accurate comparatively. Whether it’s price action study or algo trading, there is no match of insights observed from human eye – hence experts suggest to go with rule-based trading, strong risk management approach, and balanced trader’s psychology to make your trading set-up undefeated.

FAQs

What are the limitations of price action?

The price action predicts the future based on where the market has been. Basically, it studies history and makes assumptions about reversals, breakouts, and diversion points. But as they say, history doesn’t always repeat itself, price action may give you bait of reversal but only to push you deep in the hole.

How can one read price action?

To read price action, traders study the price movement on a chart and look for trends, patterns, and key support and resistance levels. Using the past changes and movements, traders assume where it’s heading next. Price action can also give a good look at the market sentiment for informed trading.

Is price action good for swing trading?

Yes, price action study is popular among swing traders and trend traders. Swing traders aim to get short to medium gains by holding positions for a few days to many weeks. They depend on price action analysis to spot trends and potential market turning points.

Instagram

Instagram