Your Ultimate Reference Guide to Pattern Day Trading

If you look closely, you will find various types of traders and investors operating in the stock markets. Depending on your capital, time horizon, and risk appetite, you can pick up whichever style suits you. But, for the sake of classification, the regulators categorize pattern day trading separately.

As you can understand from the name, traders who regularly execute high-value trades in a pattern are categorized as pattern-day traders. This blog aims to help you learn about pattern day trading and how you can benefit from it in detail.

What’s Pattern Day Trading?

Initially, you should start by understanding the definition of pattern day trading. To put it simply, a pattern day trader identifies and capitalizes on multiple trend patterns. Their aim is to execute multiple trades and maximize the benefits from potential price movements.

Here’s a breakdown of the characteristics of each component of pattern day trading. It will help you identify whether a trader can be classified as a pattern day trader or not:

- Day Trade: A day trade means buying and selling the same security within a trading day.

- High frequency trading: The holding periods are as short as minutes to hours, and the trading frequency is very high.

- Multiple Trades: A pattern day trader executes 4 or more day trades within 5 business days.

- High Percentage trades: The number of day trades constitutes over 6% of the total trades during this period.

- Margin Account: The trader uses a margin account to get more buying power. (Margin = 25% of the total market value of securities held)

- Different Markets: Pattern day trading targets highly liquid stocks and ETFs.

If you meet these criteria, your trading account will be flagged as a Pattern Day Trader (PDT) by your stock broker.

Also Read: Day Trading vs Long-Term Investing: Pros, Cons, and Key Differences

Why Understanding Pattern Day Trading is Important?

If you are an active pattern day trader, it is essential for you to learn about the pattern day trading rules. This will help you avoid pitfalls and regulatory violations. But why is there such high scrutiny on pattern day traders? Here are the reasons:

- Controlling Financial Risk: If you know the rules, you can safeguard yourself from over-leveraging the margin account.

- Regulatory Compliance: There are certain restrictions and monitoring of pattern day trading accounts. It is important that you adhere to these regulatory compliances.

- Knowing the acceptable limits: You can strategize your trades according to the pattern day trading limit.

Key Rules and Regulations: Avoiding Pattern Day Trading Violations

It is possible that you end up making pattern day trading violations if you are not aware of the rules. Here are the rules you should follow as a pattern day trader:

- Maintain a minimum balance of Rs. 2 lakhs in your Margin Account to qualify for pattern day trading.

- Track your trades regularly and avoid breaching the thresholds.

- Understand that your 5-day trading activity determines whether you qualify as a pattern day trader or not.

- Pattern day trading also applies to options. It is essential that you stay within the limits and not overexpose your capital.

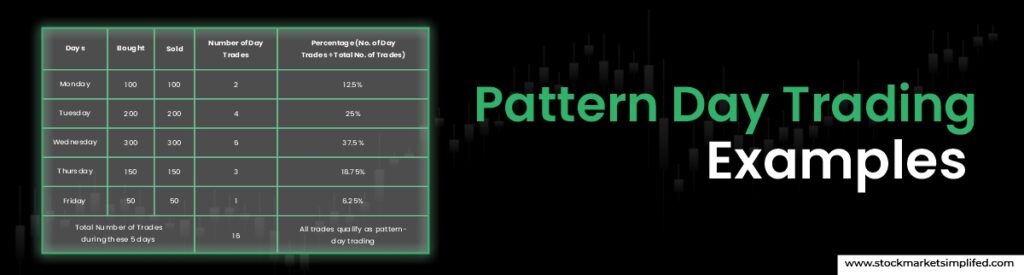

Pattern Day Trading Examples

To make it simpler for you to understand how it works, let’s take a pattern day trading example. Remember, in a day trade, the trader buys and sells the same security within a business day. In this example, a trader is targeting the stock of Company A. See how you can identify pattern day trading from the following data.

| Days | Bought | Sold | Number of Day Trades | Percentage (No. of Day Trades ÷ Total No. of Trades) |

| Monday | 100 | 100 | 2 | 12.5% |

| Tuesday | 200 | 200 | 4 | 25% |

| Wednesday | 300 | 300 | 6 | 37.5% |

| Thursday | 150 | 150 | 3 | 18.75% |

| Friday | 50 | 50 | 1 | 6.25% |

| Total Number of Trades during these 5 days | 16 | All trades qualify as pattern- day trading | ||

You can clearly see how these trades fit the definition of pattern day trading.

- The trader has executed more than 4-day trades during 5 business days.

- The number of day trades is more than 6% of the total number of trades during this period.

The Pros and Cons of Pattern Day Trading

By now, you must be curious why traders opt for pattern day trading. Are there any drawbacks to using this aggressive trading strategy? Let’s have a look:

Pros

- Make quick profits: You can easily capitalize on short-term price movements and make quick profits.

- More Turnover: While the margins are lesser, there are more opportunities to trade.

- Leverage: The biggest benefit of using margin accounts is that you have more trading power, which is ideal for pattern day trading.

Cons

- High Risk: When you execute multiple trades aggressively, these can lead to heavy losses.

- Specialized Role: Only experienced traders who can pick patterns instantly and with accuracy can succeed. It is not possible for a beginner to start pattern day trading at once.

- Restrictions: If you don’t comply with the rules and regulations, you can get penalized, or your account can be restricted.

- Stressful: Short-duration trades need you to be on your toes throughout the day. A single slip-off can cause heavy losses. Such high stakes make pattern-day trading very stressful.

Tips for Aspiring Pattern Day Traders

So, we come to the section of key tips you can follow to start pattern day trading. Here are the steps you can take to avoid the pitfalls and become successful:

- Get educated: Before you jump in, you should educate yourself and understand how pattern day trading works.

- Budget your trades: Instead of putting all your savings into this high-risk trading, you should prepare a budget and invest only that small amount you can afford to lose.

- Monitor regularly: You have to keep track of the latest trends, news and market conditions to strike your trade rightly.

- Use Stop losses: Applying stop losses on your pattern day trading orders is very important to safeguard your capital.

- Follow proper discipline: You should avoid making decisions in haste based on emotions. It’s better to stick to your strategy to make more profitable trades.

Also Read: Algo Trading: Transforming Trading into Automation

In the end….

Strategies like pattern day trading are fast-paced and exciting. However, the stakes in such trades are very high. Not just this, there are several rules and regulations you have to follow while indulging in pattern day trading. By understanding the meaning of pattern day trading and how you can implement this strategy, you can become a successful trader.

FAQs

Why does pattern day trading exist?

Pattern day trading restrictions are put in place to ensure that small retail traders do not take extraordinary risks and lose their hard-earned savings.

Why is pattern day trading bad?

As there are high stakes and fast-paced decision-making involved, pattern day trading is highly risky. If you put a single foot wrong, you can end up losing a lot of money.

Why is pattern day trading illegal?

Pattern day trading violations do attract penalties and restrictions but it is not illegal. To ensure that markets are not destabilized and traders act responsibly, these restrictions are placed on pattern day trading.

When does pattern day trading reset?

The reset period for pattern day trading is 5 days. After completion of these 5 consecutive trading sessions, your trading activity is recalculated.

Does pattern day trading apply to options?

Yes. Pattern day trading also applies to options. Traders use margin accounts to increase their purchasing power in the options markets. But, they also have to adhere to the same set of rules and regulations there also.

Instagram

Instagram