5 Options Trading Strategies For Beginners

Almost every options trader asks themselves the question at least once whether experienced traders actually know how to trade options accurately and securely. Although the markets may seem somewhat of a desert island here, let me tell you what makes it exciting – options trading strategies are your guided arsenal to tackle market fluctuations! Okay, alright, it may look like another trading system for each stock type, but once you find out the details of these elaborate methods, you will understand just how to cover your bases and make the most profits when the risks are minimized.

For new traders who are willing to trade in the options market, let us look at 5 tremendous strategies that will enhance the way you trade. Believe it or not; once you start applying these trading strategies, you will easily realize why progressive traders trust these methods!

Now, let’s discuss the options trading strategies that can be beneficial for a novice trader and explain how they work.

Covered Call

A covered call is one of the most basic options trading strategies, and it’s well-suited for inexperienced individuals. In this strategy, you acquire the stock and then write a call option on the same stock in the market. It also helps you earn income by way of the receipt of premiums without having to liquidate your stocks.

When to Use a Covered Call?

When you anticipate the fluctuations of the stock price are going to be minor through holding for the longer term rather than short-term trading.

This is useful if you’d like to earn extra income while holding onto stocks that you already possess.

How It Works:

- You buy a stock.

- The strategy involves selling a call option first at a strike price that is above the market price.

- In this option, if the price per stock does not go above the strike price by the time the options expire, then you get to keep the premium as your profit.

- If, through the contracted period, the price per stock increases to or exceeds the strike price, you are authorized to sell the stock at the agreed price – thus setting a ceiling to your profits.

Its primary advantage is that this strategy is well suited to newcomers because it guarantees stable income while minimizing the risks. Thus, if you are a beginner in nifty options trading strategies, then the covered call can be your starting strategy.

Also Read: Best Indicators for Options Trading in India

Bull Call Spread

The bull call spread is a moderately bullish strategy that aims to generate profit in the event of a relatively small increase in the underlying stock price. It refers to the process of acquiring a call option with a much lower strike price while at the same time selling a call option with a higher strike price.

When to Use Bull Call Spread?

- When you expect the stock prices to rise moderately.

- If you want to reduce costs while trading options.

How It Works:

- Buy a call option with a much lower strike price (higher premium).

- Sell a call option with a bit higher strike price (lower premium).

- The profit is limited to the difference between the two strike prices minus the total net premium paid.

Bear Put Spread

A bearish spread is a strategy for traders with a moderately bearish outlook. It involves buying a put option at a higher strike price and selling a put option at a lower strike price.

What Is Bear Put Spread Strategy?

This strategy is used to profit from a limited decline in the stock price while reducing the cost of purchasing the put option.

How It Works:

- Buy a put option with a bit higher strike price.

- Sell a put option with a little lower strike price.

- The profit is limited to the total difference between the strike prices and minus the net premium paid.

The bear put spread is an ideal choice for beginners who want to minimize risks while exploring options trading strategies in India. It ensures a predefined risk-reward ratio.

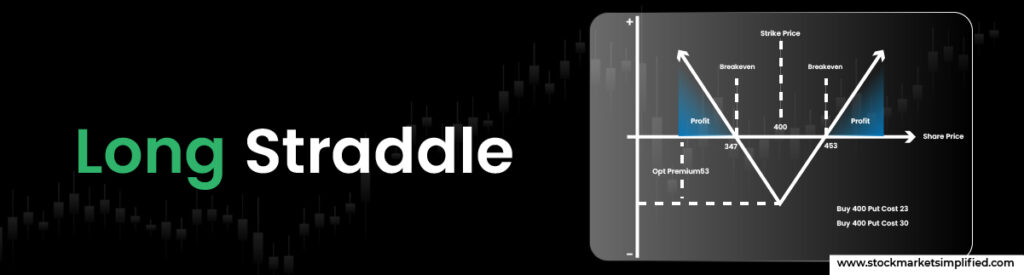

Long Straddle

The long straddle is a strategy that benefits from the significant price movements in either direction. It involves buying a call option and a put option with the exact strike price and expiration date.

Is Long Straddle a Good Strategy?

It is an effective strategy during periods of high volatility or when you expect major news to impact the stock market.

How It Works:

- Buy a call option and a put option at the same strike price.

- If the stock price moves significantly, either the call or the put option will gain in value, covering the cost of the other.

- The potential for profit is unlimited, while the loss is limited to the premium paid.

For beginners, the long straddle offers an excellent way to profit from any uncertainty without choosing a specific direction.

Iron Condor

The iron condor is also a neutral strategy that profits from low volatility. It involves creating a combination of four options contracts: selling a call and a put option at middle strike prices and buying a call and a put option at farther strike prices.

What Is Iron Condor Strategy?

It is a limited-risk, limited-reward strategy that works best when the stock price remains within a specific range.

How It Works:

- Sell a call option and a put option at strike prices close to the current stock price.

- Buy a call option and a put option at strike prices farther away to limit potential losses.

- The profit is limited to the total net premium received if the stock price stays within the middle strike prices.

The iron condor is a balanced strategy and a great way to understand how many options strategies are there for managing risk and reward.

Also Read: Top 5 Stock Market Strategies for Long-Term Growth

Why Do Beginners Need to Use Strategies?

Day trading without proper management is very dangerous, with a high likelihood of making massive losses, particularly for first-time traders. Here’s why you need to use strategies like the ones discussed above:

Risk Management: Options trading can be risky. The covered call and the bear spread established boundaries to losses.

Structured Approach: Strategies are orderly means of operating in the trade markets, thus ruling out arbitrary actions.

Profit Maximization: Segregated approaches assist you in responding to your market outlook of bullish, bearish or neutral.

Learning Curve: Structured strategies enable novices to understand the concept of options trading and structure their approach to decision-making.

By giving precisely outlined options trading strategies for novices, you can trade in the stock exchange with much more ease and effectiveness.

Conclusion

Managing options trading strategies is crucial to anyone willing to invest in the stock market with a definite plan in mind. The covered call is a steady income-producing strategy, and the iron condor is a fully hedged strategy where profits or losses depend on the market’s direction but within a balanced risk-reward ratio.

Whether you are learning about what is covered in the call strategy, the use of bull call spread, or gaining more knowledge about the more advanced strategies like the iron condor, implementing them will improve your trading experience. It is important to know how options trading is conducted as well as compare or choose an appropriate strategy according to the specific circumstances that exist in the market at a given moment to gain a considerable effect at trading.

Instagram

Instagram