The ABCs of Corporate Action: A Beginner’s Handbook

Overview

Reliance Industries just dropped some big news—on November 29, 2024, they’re doing a bonus split! If you’re a trader, you’re probably already feeling the buzz. But here’s the thing—did you know that when a company does a bonus split, the share price effectively gets halved? Sounds confusing? Don’t worry, we’re about to break it down.

In the stock market world, corporate actions are like the decisions that shape a company’s future. They can affect everything from share prices to how much money you make as a shareholder. But what exactly are these corporate actions? How do they impact your investments? And more importantly, do you, as a shareholder, get a say in the matter?

In this post, we’ll take you through the basics of corporate actions—explaining what they are, how they work, and what they mean for you as an investor. Let’s dive right in.

What is Corporate Action

A corporate action is an activity or move where publicly traded companies make material changes within an organization that directly affects the issued assets of the company. It can be shares, bonds, or any publicly released assets traded in the primary or secondary market.

For instance, you and your friends work in a group project that means every structural or foundational change would be informed to everyone, right? Likewise, corporate action is like making a big decision or change in the company that affects people who own the company’s assets such as shares.

These actions are generally approved by the board of directors or CEO of the company, however, some companies require shareholders to vote for such events as well. Such actions include spinoffs, acquisitions, mergers, stock splits, issuing dividends, etc.

Also Read: Understanding the Benefits of Holding Stocks for the Long Term

How Does It Work?

When a publicly-traded company decides to take a corporate action, such as acquisition or stock split, it often announces it to its When a publicly-traded company decides to take a corporate action, such as acquisition or stock split, it often announces it to its shareholders. Commonly, such decisions are overseen by a Board of Directors – individuals closely responsible for company’s growth or further actions. The company will give required details about the corporate action and what changes shareholders will go through after specific corporate actions.

In some companies, shareholders are also given an opportunity to vote on certain or all corporate actions undertaken by the company.

Majorly, there are major three key players that go through the major impact of any corporate actions. They are;

- Shareholders

- Bondholders

- Stakeholders

When the announcement date arrives, traders can track the impact of those changes in their brokerage account. For an instance, in a stock split, the number of shares increases, but the price of each share is lowered proportionally. Most corporate actions are considered to manage their company’s finances and meet future goals, affecting shareholders directly. But the severity of its impact depends on the nature of action taken by the organization.

Example of Corporate Actions

First let’s discuss the real-life example of corporate action.

On August 24, 2020, Apple Inc, a well-known technology company, decided to split its stocks. Before the split, each share price was worth $503. After the 4-for-1 split, the share price went down to around $125.

This corporate action didn’t change the overall investment value of Apple, but it made each share more affordable for people/traders who have been eying on Apple stock. It’s like cutting a pizza into more slices – the total amount of pizza is the same, but more people can have it. Reletable, right?

Fundamentally, there is a substantial range of activities that comes under the category of corporate action. These are (not limited to):

- Redesigning company logo or resetting the company name.

- Managing relevant financial concerns, such as bankruptcy or liquidation

- Acquisition or merger of the company

- Creating Spin-Off Companies

Types of Corporate Actions

Well, jumping into the types can help you classify the information into categories. In simpler terms, it helps categorize the undertaken action, making it easy to interpret the outcome. There are basically three types of corporate actions, including:

- Mandatory

- Mandatory (With Several Options)

- Voluntary

Let’s get into these in brief to have a basic understanding on the concepts:

Mandatory

Often implied by the governing body or major authority of the company. In such cases, board of directors perform specific actions that affect shareholders but get no vote to intervene or engage. Best example of mandatory action is allocating a dividend. Shareholders just collect the dividend on their shares. Other options of mandatory action include mergers, spin-offs, stock splits, mergers, etc.

Mandatory (With Several Options)

As the name states, in this, shareholders get a choice to opt from different options, offered by them. For example, if a company is releasing dividends in two forms – stock shares or cash dividend. In such cases, shareholders can either pick any of the options or the default option is considered. In most scenarios, shareholders get a specified deadline, once the deadline passes, the selected options will be applied.

Voluntary

Free will to participate. In this section, shareholders get an option to either engage or not engage in the voting process. Voluntary corporate actions depend on the will of shareholders and counts every vote. In some companies, shareholders must vote to move forward with the action, hence the shareholders must respond.

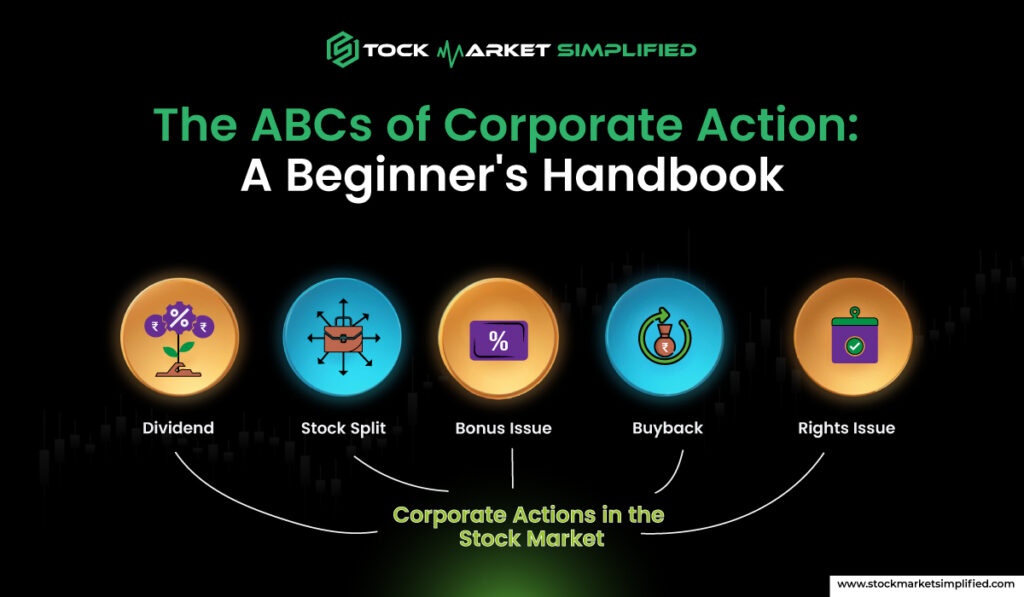

Common Corporate Actions

Till now, it has become evident that corporate actions are the activities, taken by board of directors or governing bodies that affects the issued company shares. The range of corporate actions is broad such as merger, stock splits, spin-offs, acquisitions, etc.

Here are common corporate actions, explained in brief:

Dividend Payment

The most awaiting corporate action among traders. In this, the company shares its profits with shareholders by giving them a certain amount of money for each share they own.

Stock Split

Another common corporate action that alters the existing shares of the company. In stock split, a company divides its existing shares into multiple new shares, making each share less expensive.

Stock Buyback

When an organization buys its own shares from the stock market. Mostly this is done to get a hold on a portion of available shares in the market.

Merger/Acquisition

Both are different technical terms in the books of business. In brief, companies often come together and use their combined resources to form a new company.

Spin-Off

As they say, the company is trying to spin-off their business. This happens when an existing public company creates a new, separate company and gives shares or existing shares to its current shareholders.

Bonus Issue

Jackpot offer! In this, the company gives additional shares to its existing shareholders for free, based on the quantity of shares they own.

Rights Issue

Old book, new chapter. When an organization offers rights to buy more shares at a discounted price to existing shareholders. Like the bonus, but instead of getting it for free, you get it at minimal prices.

Although the list is not limited and goes beyond, such as reverse stock split, and more. Each corporate action creates a different impact on the share prices of the company, based on its market value, fundamentals, and sustainability of business.

In Conclusion

In essence we can say that corporate actions are super important events that can influence both companies along with their shareholders, stakeholders, and bondholders. When companies reward their shareholders with dividends, change things around by splitting up parts of their business, or adjust their stock prices through buybacks or stock splits, they’re making important decisions about their finances and how they create value for investors. If you’re someone who invests or trades in the stock market, it’s important for you to understand these events properly to know their impact on your investments. Knowing how they work will help you make smarter choices when buying or selling stocks.

FAQs

What is corporate action?

The activities taken by publicly traded companies that directly influence the value of its shareholders investments. For example, distribution of dividends, granting of rights, insurance of bonus shares, execution of stock splits, etc.

What is the purpose of a corporate action?

Companies can use corporate actions for several reasons, mainly it’s to manage finances and profits of the company. Another key reason is to distribute benefits back to their shareholders.

What are the types of corporate actions?

There are majorly three types of corporate actions, mandatory action, mandatory action (with several options), and voluntary action.

Who is eligible for corporate actions?

Any publicly traded company can regulate corporate actions and any shareholders who own shares of the company are entitled to reap the benefits.

What are the fees for corporate action?

The processing fees for corporate actions on listed equity shares cost Rs 20,000/- plus 18% GST. It is one time payment needed for processing any sort of corporate action.

Who prepares the corporate action reports?

Administration division is responsible for preparing annual reports and corporate action reports, which can only be published along with the company’s financial statements. On the other hand, financial statements are mandatory elements of the annual reports.

Instagram

Instagram