Paper Trading: Meaning, Benefits, and Advantages

If you want to know what paper trading means in the stock market, keep reading. Yeah, it is more like simulation and trading on paper and not real cash. Sounds simple, doesn’t it? So why do seasoned dealers vouch for this apparently naive concept?

Let me clarify that for you! Exploring the concept of paper trading will change your entire voyage into the stock market and alter your perspective toward real trading. Although paper trading may look like exactly as it sounds – mock trading, understanding how to perform this basic move is what stands between the transformation from a confident trader and walking into the markets blindly. Once you understand that it is far more than a tool for learners, you can realize that it is actually your own trading sandbox where ideas are tested without the pressure of actual dollars on the line!

In this article, we will try to explain what paper trading is, how it functions, what advantages it has, and how does it look in the comparison with live trading. We will also explain how to do paper trading properly and briefly explain the limitations of this approach.

What is Paper Trading?

Paper trading is a simulation of actual stock market trading where individuals engage in the buying and selling of securities without utilizing actual money. In other words, it lets traders test their actions on a virtual, live platform that models the real-life market situation.

This is great for understanding the mechanics of trading as you have the risk managed that is either your new capital or a small portion of it, or there is the ability to practice new strategies when you are an experienced trader. The detailed description of the paper trading in the stock market is as follows; In simple terms, it allows the trader to get real trading experience without actually needing to have a risk of losing any money.

How Does Paper Trading Work?

The idea of paper trading is to open an imaginary trading account where people can place an order in a particular stock, monitor how a certain stock is performing on the market, and keep track of an imaginary trading portfolio. Here’s how it works:

- Setting Up: Traders open a virtual trading account on a specified trading platform. They have an option to decide on the extent of the virtual capital they are willing to employ in their operations.

- Placing Trades: Users invest in stocks, commodities or other securities and can perform buy or sell actions exactly as happens in the real world. The platform tracks these trades in real-time.

- Monitoring Performance: Portfolio holders can track the behavior of the trades, throughput, and even revenue and losses made over the years. This assists them in identifying the market trends and adapting their strategies accordingly.

- Learning Tool: When the results are out, one can understand the accuracy of the decisions made and probably correct the errors.

- Transitioning to Real Trading: After being proficient in their approach, the trader can easily switch to real trading with a much deeper understanding of the markets.

Also Read: Diwali Muhurat Trading: A Blend of Tradition and Prosperity

The Benefits of Paper Trading

It is important that anyone who wants to get the most out of this opportunity understands the various advantages that come with paper trading. Here’s why it’s an essential step for every trader:

1. Risk-Free Learning

Paper trading helps the users gain knowledge about the operations of the market without leaving such personal and precious money at stake. As such, it becomes a conducive place to be in for learning while at the same time preparing to learn from errors.

2. Strategy Development

It is a practical platform for young traders who can try out their strategies at live market prices without risking money.

3. Enhanced Market Knowledge

Due to this, users are apt to learn how the markets operate, price changes, trends, and general ways in which certain events affect stock price.

4. Confidence Building

The simulated training allows the traders to develop confidence in the strategies they are to implement as well as in their decisions.

5. Platform Familiarity

As far as those interested in getting first-hand experience trading before going live is concerned, paper trading in India is quite helpful.

Advantages of Paper Trading Over Real Trading

While live trading offers the thrill of actual gains and losses, paper trading has unique advantages that make it an essential practice for traders:

- No Financial Risk: The largest advantage of paper trading is that it does not involve real money, unlike real trading. This makes it a stress-free experience.

- Perfect for Experimentation: As such, it enables traders to use out-of-the-box approaches to trading or personally developed theories with no risk of losing the cash invested.

- Accessibility: Sources for where to do paper trading are numerous, the services offered are usually free and very simple to use.

- Ideal for Beginners: It is crucial for newcomers to have a decent understanding of trading skills but with no worries concerning the money factor.

Limitations of Paper Trading

Despite its benefits, paper trading has certain limitations that traders must be aware of:

1. Lack of Emotional Involvement

Because there is no real money involved, traders are unlikely to feel the adrenaline rush and the corresponding pressure that are important to control risk levels.

2. Unrealistic Execution

A popular scenario for trades is a real-time trade that uses the market’s prevailing price without any hitches. This may not always be the case with real trading because of liquidity or slippage in the trading process.

3. Overconfidence Risk

In the absence of an actual loss, you might get overconfident when entering live trading, which is not beneficial to the trader.

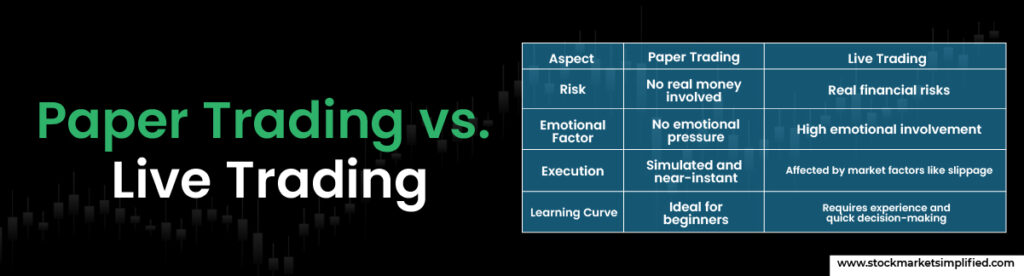

Paper Trading vs. Live Trading

Paper trading and live trading differ significantly in their approach and outcomes. Here’s a quick comparison:

| Aspect | Paper Trading | Live Trading |

| Risk | No real money involved | Real financial risks |

| Emotional Factor | No emotional pressure | High emotional involvement |

| Execution | Simulated and near-instant | Affected by market factors like slippage |

| Learning Curve | Ideal for beginners | Requires experience and quick decision-making |

Also Read: Day Trading vs Long-Term Investing: Pros, Cons, and Key Differences

How to Get Started with Paper Trading?

Getting started with paper trading is simple and straightforward. Follow these steps:

- Choose a Platform: Choose a platform that has a feature of paper trading. Most brokers and third-party service-providing companies offer free paper trading online tools.

- Create an Account: Create a demo account with virtual capital as the trading currency.

- Simulated Trading: Invest in real shares, as you would in a real trading platform, with the available features incorporated into the platform.

- Track Performance: Evaluate your trades and look at your performance by different strategies based on the results of the simulations.

- Refine Strategies: Use performance trends to alter your trading strategy.

- Analyze Results: You need to evaluate your performance from time to time to discover your strengths and areas for improvement.

If you’re wondering what paper trading is in India or how to start, many platforms cater to the Indian stock market, ensuring a localized trading experience.

Conclusion

Paper trading can also be used as effective way for traders to develop their skills, practice their plans, and get experience in other conditions without any losses. It is not a live trading simulation, but it provides great information on the markets and the trading platforms.

Regardless of whether you are new in the field and asking yourself, ‘What is paper trading in India?’ or if you are a professional trader seeking for new ideas, paper trading is a first step to achieving success. Take the chance and learn, and when you are ready, move easily to the real markets.

Always keep in mind that paper trading online can help you create a good background. However, you must know its weakness and shift your mentality as you start actual trading. Happy trading!

Instagram

Instagram