REITs: How to Invest in Real Estate Through the Stock Market

India’s REITs have thrived since their launch, with GAV surging threefold and cumulative distributions topping Rs. 18,000 crores since their inception five years ago. This outperformance underscores why investors should consider adding REITs to their portfolios for a steady income and growth potential, and that is exactly what this blog will discuss.

What Are REITs? A Beginner’s Guide

REITs (Real Estate Investment Trusts) are firms that own and operate income-producing real estate properties. They are similar to mutual funds, where investors pool their money to invest in a variety of properties. The key difference is that REITs primarily invest in real estate investment trusts and related assets like office buildings, shopping malls, hotels, and residential apartments. REITs work in four simple steps –

- Investors purchase shares of a REIT just like they would buy shares of a stock.

- The REIT uses this money to acquire, develop, or finance income-producing real estate properties.

- The properties generate rental income or other types of income, such as property appreciation.

- REITs must then distribute at least 90% of their taxable income to shareholders as dividends, in which case the trusts are not subject to corporate income tax.

You can invest in REITs directly or through real estate stocks, which are stocks of companies involved in the real estate industry, such as homebuilders, construction companies, real estate developers, and property management firms.

Also Read: Sector Investing: How to Pick Stocks in Different Industries?

The Benefits of Investing in REITs

- Stable Income: REITs offer regular dividends due to their obligation to distribute 90% of taxable income.

- Diversification: REITs provide exposure to real estate, diversifying your portfolio beyond traditional stocks and bonds.

- Professional Management: Experts manage REITs, saving you time and potentially offering cost advantages.

- Liquidity: REITs trade on exchanges, allowing easy buying and selling.

- Capital Gains: REIT unit prices can fluctuate, offering the potential for gains.

- Accessibility: REITs generally have lower entry points compared to direct property ownership.

- Tax Benefits: REITs often avoid corporate income tax and may offer favorable dividend tax treatment.

Different Types of REITs: Which One is Right for You?

- Equity REITs: Think of these as landlords. They own buildings like offices, shops, or apartments and make money from rent.

- Mortgage REITs: These guys are like banks but for real estate. They lend money to people buying properties and make money from the interest they charge. Interest rates can affect their earnings.

- Hybrid REITs: A mix of the two above. They own properties and lend money, so they get both rent and interest.

- Publicly Traded REITs: These are like real estate investment trust stocks. You can buy and sell their shares on the stock market. They’re easy to buy and sell, but their prices can go up or down a lot.

- Non-Traded REITs: These are like private clubs. You can’t buy and sell their shares on the stock market. They’re harder to sell but might give you better returns.

- Private REITs: These are like exclusive clubs. Only certain people can invest in them. They’re super hard to sell, but might have high rewards.

When selecting a REIT, consider your investment goals, risk tolerance, and time horizon. Research individual REITs, evaluate their financial performance, and consider factors such as property type, geographic focus, and management team. Consulting with a financial advisor can also be helpful.

How to Analyze REIT Performance?

When evaluating REIT performance, valuation metrics are crucial in determining whether a REIT is fairly priced. Here are some key metrics to consider –

1. Price-to-NAV Ratio

This ratio compares the market price per unit of a REIT to its net asset value (NAV) per unit.

- Premium: If the price-to-NAV ratio is above 1, it indicates the REIT is trading at a premium to its NAV. This could suggest that investors are willing to pay more than the underlying asset value.

- Discount: If the price-to-NAV ratio is below 1, it indicates that the REIT is trading at a discount to its NAV, which could suggest that it is undervalued.

For example, if a REIT’s NAV per unit were Rs 399, while its market price was Rs 382 last month, it would translate to a price-to-NAV ratio of 0.96, indicating a 4% discount.

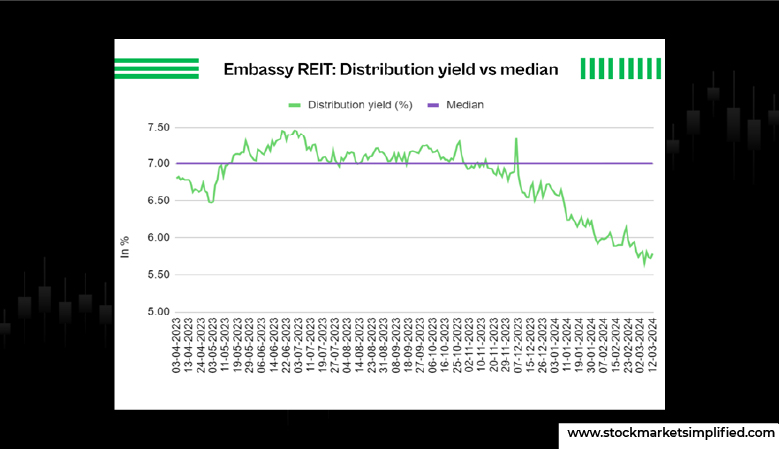

2. Distribution Yield

This metric measures the annual dividend or distribution paid by a REIT as a percentage of its market price.

- Higher Yield: A higher distribution yield generally indicates a higher income potential. However, it’s essential to consider the sustainability of the distribution.

- Comparison: Compare the distribution yield of the REIT to its historical average and industry benchmarks.

For example, the chart below shows Embassy REIT’s one-year distribution yields. As of March 12, 2024, the yield was below the one-year median, indicating that it might be overpriced.

Key Metrics to Consider When Investing in REITs

- FFO (Funds from Operations): A measure of a REIT’s operating cash flow, adjusted for non-cash items.

- AFFO (Adjusted Funds from Operations): A more comprehensive measure of a REIT’s sustainable cash flow, accounting for recurring capital expenditures.

- Dividend Payout Ratio: The percentage of a REIT’s FFO or AFFO paid out as dividends.

- Occupancy Rate: The percentage of a REIT’s properties that are leased to tenants.

- Debt-to-Equity Ratio: A measure of a REIT’s financial leverage.

Strategies for Building a REIT Portfolio

To construct a well-diversified REIT portfolio, consider spreading investments across various property types and geographic regions. This helps mitigate risks and capitalizes on diverse market opportunities. A balanced approach involving equity REITs for capital appreciation and mortgage REITs for income can be beneficial.

Thoroughly evaluate management teams, focusing on experience and alignment of interests. Analyze financial health using key metrics like FFO, AFFO, dividend payout ratio, and debt-to-equity ratio. One must also be mindful of interest rate changes and the overall economic outlook, as these factors can significantly impact REIT performance. Regularly review and rebalance your portfolio to maintain your desired asset allocation and risk tolerance.

Also Read: How to Start Investing with Little Money: Smart Strategies for Beginners

Risks to Consider Before Investing in REITs

- Interest Rate Sensitivity: Rising interest rates can negatively impact REIT profitability, as higher borrowing costs can reduce profit margins and dividend payouts.

- Property-Specific Risks: Factors like property values, debt, location, interest rates, and tax laws can influence the risk of individual REIT investments.

- Potential High Fees: REITs may incur transaction and management fees, which might not always align with shareholder interests.

- Market Risk: REITs, traded on stock exchanges, face market fluctuations. Factors like recessions, interest rate changes, or natural disasters can impact the entire market, making market risk difficult to avoid.

Conclusion: The Future of REITs in the Real Estate Market

REITs are poised to expand into asset classes like warehouses, data centers, and hospitality, driving market growth. MSM REITs could democratize real estate investment. REITs can also contribute to government infrastructure development by financing income-generating projects. Real estate investment trusts in India are on a strong trajectory. ICRA forecasts a 6.0-6.5 times expansion in REIT-ready office supply due to a 3.3 times surge in the past five years, reaching 82 million square feet in the top seven cities. This indicates a promising future for REITs in India.

Instagram

Instagram